Planning and Finance Series: Property Taxes and Local Tax Structures

Published in 2014

by Patrick L. Dugan, Everett, Washington

For many years, as a peer reviewer in the Government Finance Officers Association’s (GFOA) Distinguished Budget award program, I reviewed local governmental budgets from across the nation. In those reviews, I was always struck by how the financial structures of local governments vary dramatically from state to state. In my last column, I explored some differences in how local governments levied property taxes from state to state. In this column, I will expand on that discussion by exploring how the variation in the role of property taxes in local government from state to state might shape the operations of local government.1

Reliance on property taxes

Local governments levy a wide variety of different taxes in addition to the property tax. These taxes include taxes on general sales, selective sales taxes on particular goods and services (such as gas, alcohol, tobacco, utilities, etc., also known as excise taxes), taxes on individual and corporate income, taxes on motor vehicles, etc.2

Property taxes are by far the most significant among all types of taxes, providing 75 percent of all of the tax revenue collected by all local governments nationwide. General sales taxes provide the next largest amount (16 percent), and selective sales taxes provide another 4.7 percent. While income taxes provide 4.2 percent of all local tax revenue collected nationwide, the tax is only collected by local governments in only 14 states. All other taxes combined make up only 4 percent of local taxes.

While all local governments depend on the property tax to a large extent, the degree of that dependence varies substantially. For example, of all taxes collected in Maine, property taxes represent 99 percent, while in Arkansas, property taxes are only 42.7 percent. In only two states, Arkansas and Louisiana, does another tax, the general sales tax in both cases, provide more local revenue than the property tax.

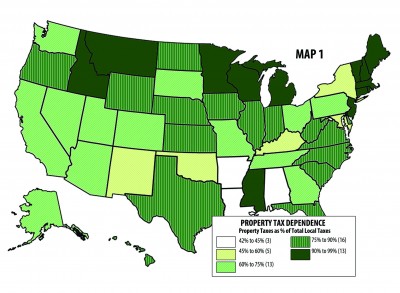

Map 1 shows the dependence of local governments on the property taxes for each state. As illustrated, the reliance on property taxes generally is highest among the New England States and the lowest in a few Deep South States, although no clear overall pattern is present. In the West, (Figure 1 shows Western Planner states with California) Montana and Idaho, followed by Oregon and North Dakota are the most dependent on just the property tax, while New Mexico and Washington are the most diversified. The states that are less dependent on the property tax generally use the sales tax as well, with Nevada being the exception, using the selective sales taxes instead. New Mexico, followed by Arizona and Colorado, rely most on the sales tax.

While several larger eastern states allow local governments (notably New York, Ohio, Pennsylvania, and Maryland) to tax personal and corporate income significantly, only Oregon local governments use this tax in the West and only to a very limited extent. Washington State has probably the most diversified tax structure of any of the Western states, using special sales taxes (mainly taxes on utilities) and sales taxes, in addition to the property tax.

Implications on governmental operations

Economic growth and new development will affect local governmental tax revenue very differently in states that rely more heavily on property taxes (Montana, Idaho, and Oregon), versus in states that are more diversified and rely on sales and other taxes, as well as property taxes (New Mexico and Washington).

A diversified tax structure (New Mexico, Nevada, and Washington) generally benefits local government by generating revenue from a variety of sources. This allows local governments take advantage of changes in various parts of the local economy and reduces the necessity of relying primarily on new development for increased revenues.

There is, however, a drawback when that diversification is provided by the sales tax. While the property tax tends to be a very stable tax, not prone to change dramatically from year to year, the sales tax is a very violable tax with revenues swinging widely with economic conditions through business cycles. For example, heavy reliance on the sales tax usually made the fiscal impacts of the great recession on local finance worse. While the impact of the recession on property taxes varied widely (depending on the severity of the collapse of housing market in the area and the legal structure of the property tax in the particular state), the impact of the recession on sales tax revenue tended to be worse than the losses (if any) in property taxes.3

The tax structure of local governments influences the fiscal impact of new development on those local governments. In states where local governments rely most heavily on property tax and little, if any, on sales tax (such as Montana, Idaho and Oregon), the type of new development is not as important in those communities that also rely significantly on the sales tax (such as in Arizona, Colorado and New Mexico).

In sales tax states, commercial development generates far more tax revenue than in those states that depend primarily on the property tax. Even in states (as described in the last article) where commercial development is taxed more than residential development (such as Arizona), commercial development provides both more property taxes than residential uses (because of the higher tax rate) and greater sales tax revenues. In addition, substantial revenue can be generated in a sales tax state by increased sales activity in existing stores through economic growth, even without substantial new physical development.

The fiscal impacts of various alternative development patterns will be very different in Oregon, versus those impacts in Arizona or New Mexico. However, studies regarding the fiscal impact of different development patterns, such as urban sprawl, seldom note the differences in fiscal structure in their general conclusions about the impacts of growth on local governmental finance and budgets.

Tax structures can also influence land use decisions and planning. Since various land use patterns affect revenues through different tax structures in dissimilar ways, different tax structures will encourage different land use patterns. A community that is dependent on sales taxes (such as in New Mexico) may well be more aggressive in promoting commercial uses over other uses, while communities that receive most of their revenue from property taxes (such as in Oregon) will benefited by all types of uses and particular types of uses would not be unduly favored.

Property taxes present the easiest target for taxpayers to express their frustrations about taxes or government. Such frustrations can often lead to “taxpayer revolts,” consisting of voters opposing property tax levies or by voting in limits or constraints on property taxes. Governments that are heavily dependent on property taxes are the most vulnerable to the consequences of these taxpayer revolts. While more diversified governments may also be affected by these revolts, this fiscal diversity allows them more flexibility in their ability to manage such impacts.

Conclusion

The general character of local governments is very similar from state to state. A person employed by a city in Washington State is likely to feel at home working in a city in New Mexico. The similarities between states, however, can often cloud the important differences, such as how local governments raise their funds, that can affect the ways in which local governments operate. Since land use patterns can affect revenues differently in different tax structures, these difference structures can also have significant implications on how communities grow. The devil is often in the detail.

Patrick L. Dugan has held various financial and planning positions in cities, counties, and regional agencies in three states over the last 30 years. Now a private consultant in Everett, Washington, he can be reached at consult.dugan@frontier.com.

Endnotes

- All data in this article is from the US Census of Governments, 2011: https://www.census.gov/govs/local/.

- The reader should note that this discussion includes all local governments, not just cities or counties. Also, it includes only taxes, and not other forms of revenue. It does not include property or other taxes levied by the State.

- The exception to this probably was in states where growth in energy development buffered the local governments from the impacts of the great recession.